SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934

![[MISSING IMAGE: sg_jane-henney.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/sg_jane-henney.jpg)

Lead Independent Director

Thursday, March 10, 2022

www.virtualshareholdermeeting.com/ABC2022

![[MISSING IMAGE: sg_kouroshqpirouz-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/sg_kouroshqpirouz-pn.jpg)

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

| | | ||||||||||||

| It is important that your shares be represented and voted at the Annual Meeting. We urge you to vote by using any of the below methods. | ||||||||||||

|  | ||||||||||||

|

|

| |||||||||||

| |||||||||||||

| | | ||||||

| | | | | Vote via the Internet Visit www.proxyvote.com and follow the instructions. | | | |

| | | | | Vote by phone Call Toll-Free 1-800-690-6903 inside the United States or Puerto Rico and follow the instructions. | | | |

| | | | | Vote by mail If you received a proxy/voting instruction card by mail, you can mark, date, sign and return it in the postage-paid envelope furnished for that purpose. | | | |

| | | Important Notice Regarding Availability of Proxy Materials for AmerisourceBergen's Annual Meeting of Shareholders to be held on March 10, 2022 | | | |||

| | | The Proxy Statement and Annual Report on Form 10-K are available at investor.amerisourcebergen.com and www.proxyvote.com. | | | |||

| | ||||||||

Proxy Statement Highlights

| ||||||||

| | | |||||||

| ||||||||

| | | |||||||

| ||||||||

| | | |||||||

| | | | | | 2 | | | |

| | | | | | 4 | | | |

| | ||||||||

| | | | | 5 | | | ||

| | | | | | 7 | | | |

| | | | | | 9 | | | |

| | | | | | 11 | | | |

| | ||||||||

| | | | | 13 | | | ||

| | | | | | | | ||

| ||||||||

Non-Employee Director Compensation at | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| | | | | 20 | | | ||

| | | | | | 22 | | | |

| | | | | | 28 | | | |

| | | | | | 31 | | | |

| | | | | | 32 | | | |

| | | | | | 34 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | ||||||||

| | | | | 37 | | | ||

| | | | | | 37 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | ||||||||

| ||||||||

| | | | | 71 | | | ||

| | | | | | 71 | | | |

| | | | | | 83 | | | |

| | ||||||||

| | | | | 85 | | | ||

| | | | | | | | ||

| | ||||||||

| ||||||||

| ||||||||

| | | | | 86 | | | ||

| | | | | | | ||

| | ||||||||

| ||||||||

| | | | | | | |||

| | | | | | | | ||

| | | | | | 93 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | ||||||||

| | | | | A-1 | | | ||

| | | | | | B-1 | | |

January 18, 2019

Dear Stockholder:

As your Lead Independent Director, I am pleased to invite you to attend our 2019 Annual Meeting of Stockholders on Thursday, February 28, 2019 at 2:00 p.m. Eastern Time. The meeting will be held at the Sofitel Philadelphia, 120 South 17th Street, Philadelphia, Pennsylvania. The Notice of the 2019 Annual Meeting of Stockholders and the proxy statement describe the items of business for the meeting. Your vote is very important. Whether or not you plan to attend the 2019 Annual Meeting of Stockholders, we urge you to vote and to submit your proxy over the Internet, by telephone or by mail.

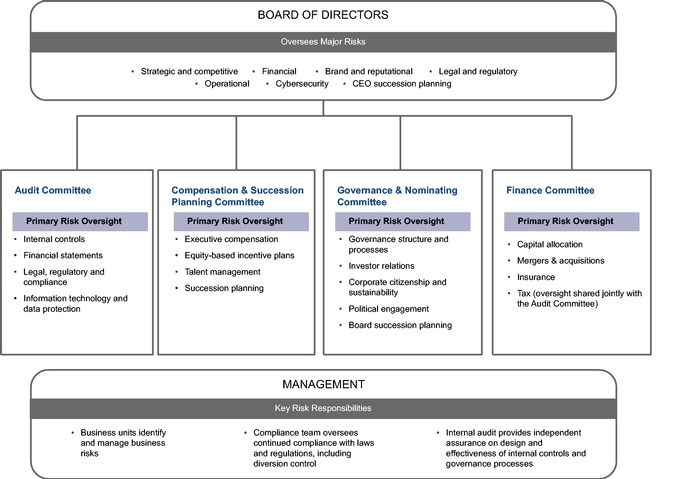

The AmerisourceBergen Board of Directors believes that effective governance is critical to a successful long-term strategy. We remain committed to a strong and independent Board. I take very seriously my responsibility to ensure that our independent directors have oversight of key aspects of the Company. The Board is informed about, and regularly discusses, AmerisourceBergen's risk profile, and executes its oversight responsibility directly and through its committees. All of our committees, other than the Finance Committee, are comprised entirely of independent directors.

Our Board considers specific risk topics throughout the year, including risks associated with government regulation as well as with the Company's strategic objectives, business plan, operations, distribution of controlled substances, information technology (including cybersecurity) and capital structure, among many others. I am proud of the Board's oversight of key challenges in fiscal 2018, including headwinds at certain of our businesses and a rapidly changing healthcare landscape. On behalf of the entire Board, we encourage you to read more about our robust governance structure, including in the "Proxy Statement Highlights" and "Highlights of Our Corporate Governance Practices and Policies" sections on the following pages, and in the "Corporate Governance" section beginning on page 23.

We are also committed to constructive stockholder engagement. Over the past year, AmerisourceBergen expanded its stockholder outreach, as discussed in the "Stockholder Engagement" section beginning on page 29. AmerisourceBergen's engagement with stockholders this past year focused on, among other things, corporate governance and the Board's oversight and risk management role. Through meetings with some of our largest institutional investors and others, we gained critical insight into the questions and concerns that stockholders have about our governance practices.

For the remainder of fiscal 2019 and beyond, we will miss the valuable perspective and dedication of Douglas R. Conant who, as previously announced, will not be standing for re-election to our Board of Directors at the 2019 Annual Meeting of Stockholders. On behalf of all my colleagues on the Board, I sincerely thank Mr. Conant for the exceptional leadership and commitment that he has demonstrated during his tenure as a director.

Your vote is very important to us. We strongly encourage you to read both our proxy statement and annual report in their entirety, and ask that you vote with our recommendations.

Thank you for your continued investment in AmerisourceBergen.

| ||

![]()

1

Proxy Statement Highlights|20192022 AmerisourceBergen Proxy

ROXY STATEMENT HIGHLIGHTS

| |||||||||||||

| |||||||||||||

| | | | | Board Recommendation | | | | Further Information | | ||||

| | | | | | | | ||||||

| | |||||||||||||

| | | | | | | | |||||||

| |||||||||||||

| | | | |||||||||||

| | | | ||||||||||

| | | | | | | | | ||||||

| |||||||||||||

| | | |

2![]()

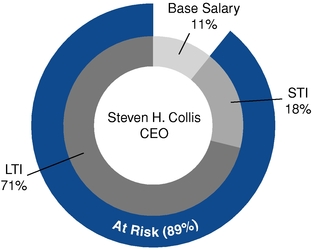

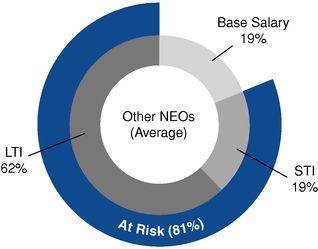

Name Ornella Barra Steven H. Collis D. Mark Durcan Richard W. Gochnauer Lon R. Greenberg Jane E. Henney, M.D. Kathleen W. Hyle Michael J. Long Henry W. McGee Douglas R. Conant* Number of Meetings in FY2018: healthcare spectrum. We have opioid epidemic. P Election of Directors Alliance’s Designated Director Nominee Overboarding Policy We seek individuals with diverse backgrounds, skills and expertise to serve on our ” Corporate Governance and Related Matters Age: Expertise None. Healthcare and Distribution Risk Sustainability & Corporate Compensation/Benefits Collis None. Global Governance and Risk D. Mark Durcan Advanced Micro Devices, Veoneer, ASML Holding NV. Global Markets: Contributes deep understanding of global markets and extensive experience in managing global manufacturing, procurement, supply chain and quality control for a multinational corporation and, as former member of the board of MWI Veterinary Supply, Inc., has important Information Technology: Has unique and in-depth knowledge of technology and capability to drive technological innovation. Gochnauer None. Governance Experience: Serves as director of Risk Oversight: Extensive experience overseeing the management of risk on an enterprise-wide basis. Greenberg Ameriprise Financial, Global Markets: Has valuable business and executive management experience in distribution and global operations acquired as Chief Executive Officer of UGI Corporation. Healthcare Expertise: Contributes experience and knowledge of the healthcare industry from his perspective as a former director of healthcare organizations. Governance and Regulatory Experience: Served as Chief Executive Officer and Chairman of the Board of UGI Corporation, as a director of subsidiaries of UGI Corporation, and as a director of Aqua America, Inc. Mr. Greenberg also currently serves as a director of Ameriprise Financial, Inc. None. Healthcare Expertise: Provides in-depth knowledge and industry-specific perspective acquired through her experience as a medical oncologist, prominent government and academic posts, and tenure as director of pharmaceutical and insurance companies. Hyle Bunge Limited. Governance and Risk Oversight: Current Chair of Bunge Limited and former director of The ADT Corporation. Risk Management: Held senior management positions at Constellation Energy, ANC Rental Corp., and Black & Decker Corporation and brings extensive experience in management, operations, capital markets, international business, financial risk management and regulatory compliance. Long None. Global Markets and Distribution Expertise: Contributes critical insight into international markets and has an in-depth knowledge of business and strategic opportunities for wholesale distribution. Governance and Risk Oversight: Serves as Chairman, President and Chief Executive Officer of Arrow Electronics, Inc. Information Technology: Familiarity with technology solutions and IT services through experience in electronic components industry. McGee Tegna, Inc. Information Technology: Has a deep understanding of the uses of technology and application to marketing and media. Teaches courses on digital transformation. Governance and Risk Oversight: Current director of Tegna Inc. and Pew Research Center. Has taught MBA courses on leadership and corporate accountability. Served as President of HBO Home Entertainment and in other leadership positions within HBO. Vote Recommendation active board membership. Name Ornella Barra(5) Douglas R. Conant(6) D. Mark Durcan Richard W. Gochnauer Lon R. Greenberg Jane E. Henney, M.D. Kathleen W. Hyle Michael J. Long Henry W. McGee The amounts reported represent the grant date fair value for equity awards shown in accordance with Accounting Standards Codification 718, disregarding the estimate of forfeitures related to service-based vesting conditions. There were no forfeitures by the directors in fiscal year Annual Retainer Annual Retainers. A director may elect to have the annual retainer paid in cash, Common Stock or restricted stock units, or credited to a deferred compensation account. Payment of annual retainers in cash will be made in equal quarterly installments. reimburse them for the cost of education programs, transportation, food and lodging in connection with their service as directors. 21 Chair experience and a strong working relationship with her fellow directors. chaired by and comprised solely of independent directors; a majority of the directors serving on our Compliance and Risk Committee and Finance Committee are independent directors; and our non-employee directors are encouraged to, and often do, have direct contact with our senior managers outside the presence of our executive officers. updates the corporate governance principles and the committee charters from time to time to reflect leading corporate governance practices. McGee and Dennis M. Nally. Education Tenure Policy shareholders. shareholders. program going forward. Shareholders. Firm For Fiscal Year 2022 Our External Auditor shareholders. Shareholders Vote Recommendation biographies on pages 19 and 16, respectively. Fee Category Audit Fees Audit-Related Fees Tax Fees All Other Fees TOTAL Audit fees consisted of fees for the audit of Audit-related fees in both fiscal year 2020 and 2021 included due diligence fees related to the previously announced agreement to acquire the majority of the Alliance Healthcare businesses from Walgreens Boots Alliance and other corporate development activity. eport of the Audit Committee 2021. 2021. compensation. Related Matters Components of the Executive Compensation Program Cash Fixed The Compensation Committee takes into account job performance, scope of role, duties and responsibilities, expected future contributions, peer group and other market pay Variable Actual payout based on Company Performance Shares, Restricted Stock Units and Stock Options Variable Actual value is determined by Company performance over a three-year time frame and/or linked to stock extent any such metric exceeded its target range. The stretch portion is calculated by increasing the earned bonus by an additional 5% for every 1% that actual performance exceeds target on the key performance metric. Corporate Performance Measure Adjusted EPS Adjusted Operating Income Adjusted Operating Income Margin Adjusted Free Cash Flow opioid litigation settlement accrual. The downward adjustment made to the CEO’s annual cash bonus award was greater than the downward adjustment made to the other NEOs due to a variety of factors, including shareholder feedback. Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Looking Ahead: Fiscal Year Plan (or our 2022 Omnibus Incentive Plan subject to shareholder approval at the 2022 Annual Meeting). 2021. shareholders. Metric Compound Annual Adjusted EPS(1) Average Annual Adjusted ROIC(2) our long-range plan. In the case of the 2023. Elements ” acquired without regard to how the transaction may affect them personally. We believe that this structure provides executive officers with an appropriate incentive to cooperate in completing a change in control transaction. The Board and the Compensation Committee also have discretion under our equity plans to take certain actions in the event of a change in control. These actions include canceling options that are not exercised within 30 days after a change in control; cashing out outstanding options; canceling any restricted stock 2021. Tables Name and Principal Position Steven H. Collis Chairman, President and Executive Officer Chief Tim G. Guttman Executive Vice President and Chief Financial Officer(1) John G. Chou Executive Vice President and Chief Legal & Business Officer James F. Cleary, Jr. Executive Vice President and President, Global Commercialization Services & Animal Health(2) Robert P. Mauch Executive Vice President and Group President, Pharmaceutical Distribution & Strategic Global Sourcing Salary . The amounts reported as salary represent the base salaries paid to each of the named executive officers for each fiscal year shown. The amounts reported represents the grant date fair value of the performance share awards at maximum level attainment: Mr. Mauch — $3,960,018. All Other The following table shows the specific components of the amounts Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch benefit restoration plan do not vest in full until an employee reaches age 62 (or age 55 with more than 15 years of service), except that vesting is accelerated for disability, death and a change in control (as long as the participant is employed by the Company on the date of the change in control). If a participant is terminated for cause, he or she forfeits all vested and unvested account balances under the benefit restoration plan. Control.” Termination of Employment without Cause or Resignation with Good Reason. Our named executive Conviction of a felony or a misdemeanor involving moral turpitude that materially harms the Company Retirement Benefits and Deferred Compensation. Following retirement or termination of employment, our named executive officers will receive payment of retirement benefits and deferred compensation under the various plans in which they participate. The value of the deferred compensation as of September 30, Employment or Change in Control Name Steven H. Collis Tim G. Guttman John G. Chou James F. Cleary, Jr. Robert P. Mauch Equity Awards. Our restricted stock unit, performance share and stock option awards include provisions that result in the vesting or forfeiture of awards, depending on the reason for termination of employment. These provisions are as follows: Voluntary Termination by Executive Involuntary Termination by AmerisourceBergen within 2 Years of Change in Control Related Matters Pay Ratio Because the SEC rules for identifying the median employee and calculating the pay ratio permit companies to use various methodologies, assumptions, exemptions, and estimates, the pay ratios reported by other companies may not be comparable with the ratio we have provided. Advisory Vote to Approve the Compensation of our Named Executive Officers ” Unless the Board modifies its policy on the frequency of holding this vote, the advisory vote is currently held every year, and the next vote on the frequency of the advisory vote is expected to occur at the 2023 Annual Meeting of Shareholders. The Company may not: (i) implement any cancellation/regrant program pursuant to which outstanding stock options or stock appreciation rights are cancelled and new stock options or stock appreciation rights are granted in replacement with a lower exercise price per share; (ii) cancel outstanding stock options or stock appreciation rights with exercise prices per share in excess of the then current fair market value per share of Common Stock for consideration payable in cash, equity securities of the Company or in the form of any other Grant, except in connection with a change in control transaction, or (iii) except in connection with an event of any change in the outstanding Common Stock of the Company by reason of reorganization, merger, consolidation or other similar transactions, otherwise directly reduce the exercise price in effect for O Steven H. Collis(3) Tim G. Guttman(3) John G. Chou(3) James F. Cleary, Jr.(3) Robert P. Mauch(3) Ornella Barra(6) Douglas R. Conant(7)(8) D. Mark Durcan(7) Richard W. Gochnauer(7) Lon R. Greenberg(7) Jane E. Henney, M.D.(7) Kathleen W. Hyle(7) Michael J. Long(7) Henry W. McGee(7) All directors and executive officers as a group (17 people)(9) BlackRock, Inc.(10) Vanguard Group Inc.(11) Walgreens Boots Alliance Holdings LLC(12) Plan Category Equity compensation plans approved by security holders Equity compensation plans not approved by security holders Total compensation program in response thereto, please see page 41 of this proxy statement. decisions. virtual meeting. my shares? March 9, 2022. shares, you must do so over the Internet or by telephone prior to the meeting. . 6. providing such services. All costs and expenses of any solicitation, including the cost of preparing this proxy statement and posting it on the Internet and mailing the Notice of Internet Availability of Proxy Materials, will be borne by AmerisourceBergen. Shareholders. principal executive offices. The proxy solicited by our Board of Directors for the to Non-GAAP Reconciliation (In thousands, except per share data) GAAP Gain from antitrust litigation settlements LIFO expense PharMEDium remediation costs New York State Opioid Stewardship Act Goodwill impairment charge Acquisition-related intangibles amortization Employee severance, litigation and other Loss on consolidation of equity investments Impairment of non-customer note receivable Loss on early retirement of debt Tax reform(1) Adjusted Non-GAAP measure is useful to investors as a supplemental measure of the ![]()

2019 AmerisourceBergen Proxy |Proxy Statement HighlightsDIRECTOR NOMINEES AND BOARD SUMMARY Age Director

Since Independent Executive Audit Compensation

and

Succession

Planning Finance Governance

and

Nominating

Co-Chief Operating Officer of Walgreens Boots Alliance, Inc. 65 2015 No X

President, CEO and Chairman of AmerisourceBergen Corporation

57 2011 No n

Retired CEO of Micron Technology, Inc. 57 2015 Yes X X

Retired CEO of United Stationers Inc.

69 2008 Yes X X n

Retired CEO of UGI Corporation 68 2013 Yes X n X

Home Secretary for the National Academy of Medicine

71 2002 Yes X EO EO EO EO

Retired Senior Vice President and Chief Operating Officer of Constellation Energy 60 2010 Yes X X

CEO of Arrow Electronics, Inc.

60 2006 Yes X n X

Senior Lecturer at Harvard Business School and Retired President of HBO Home Entertainment 65 2004 Yes X X n

Retired CEO of Campbell Soup Company

67 2013 Yes X X 1 9 4 7 7 ■ChairXMemberEOEx Officio Member*Mr. Conant is a current director but will not be standing for re-election at the 2019 Annual Meeting of Stockholders.![]()

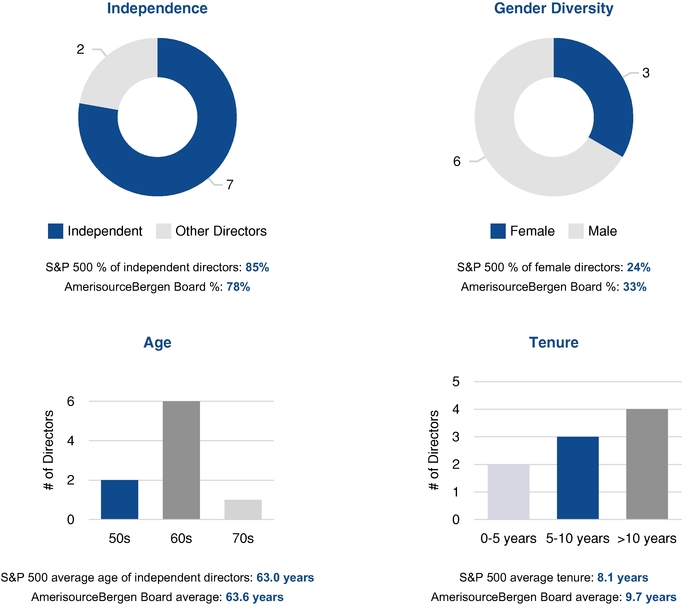

3Proxy Statement Highlights|2019 AmerisourceBergen ProxyPresented below is a snapshot of the expected composition of our Board of Directors immediately following the 2019 annual meeting, assuming the election of the nine nominees named in the proxy statement. For comparison purposes, we have also presented comparable metrics for the constituents of the S&P 500 Index. (Data for the S&P 500 Index is based on theSpencerStuart Board Index 2018.)

4![]()

2019 AmerisourceBergen Proxy |Highlights of our Corporate Governance Practices and PoliciesHIGHLIGHTS OF OUR CORPORATE GOVERNANCE PRACTICES AND POLICIESOur Board consistently seeks to implement leading practices and policies in corporate governance, with emphasis on maintaining the Board's independence to provide effective oversight of management and ensure accountability to our stockholders. Below, we highlight our key corporate governance practices and policies:Against Board of DirectorsIndependenceThe majority of our director nominees are independent (seven out of nine). Our corporate governance principles require us to maintain a minimum of 70% independent directors on our Board (see pages 12 and 25). Independence of Key Oversight CommitteesAll members of our Audit Committee, Compensation and Succession Planning Committee and Governance and Nominating Committee are independent (see page 25). Lead Independent DirectorOur corporate governance principles require Special Meeting Succession Planning for ChairmanThe Company plans to split the role of Chairman of the Board and Chief Executive Officer, commencing with the Company's next Chief Executive Officer. At that time, the Chairman role will be assumed by an independent director (see page 24). Succession Planning for Chief Executive OfficerWe undertake succession planning and maintain an emergency succession plan for our Chief Executive Officer (see page 19). Risk OversightOur full Board and each of our Board committees actively engage in risk assessment and management for all aspects of our business, including our compensation policies and practices, with certain specific responsibilities for risk oversight also designated in the committee charters and our corporate governance principles. Our corporate officers and senior managers report on risk exposure at regular intervals to the appropriate committee or full Board. DiversityOur directors have diverse business experiences, backgrounds and expertise in a wide range of fields, all of which are critical to understanding our businesses, competitive position and risks. Our Board has a long-standing receptiveness to gender and ethnic diversity and is especially proud of the representation on our Board of three leading women in the fields of business, medicine, and pharmaceuticals and a leading African-American businessman with extensive experience in corporate governance. Overboarding PolicyPursuant to our overboarding policy, if our Chief Executive Officer serves as a director, he or she may only serve on the board of one other public company. Non-employee directors should not serve on more than three other public company boards (see page 13). Tenure PolicyOur policy for directors' tenure provides that a director will resign at the annual meeting of stockholders following his or her 75th birthday and a director will tender his or her resignation for consideration by the Governance and Nominating Committee when his or her employment or principal business association changes materially. A director who is an employee will resign when he or she retires or is no longer employed by us. RefreshmentTwo of our eight non-employee director nominees have served on the Board for five years or less. Additionally, we encourage our Board to rotate its committee Chairs on a regular basis. ![]()

![]()

51![[MISSING IMAGE: tm2133602d1-fc_businesspn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-fc_businesspn.jpg)

Corporate Governance Practices and Policies|2019 AmerisourceBergen Proxy Annual Evaluation ProcessOur Board has a comprehensive annual evaluation process for the Board and each of its committees, which is led by the Chair of our Governance and Nominating Committee and the Board's Lead Independent Director (see page 28). Review of Committee ChartersEach of the committees annually reviews and recommends updates to its charter to the full Board and the Governance and Nominating Committee annually recommends updates to the corporate governance principles (see page 28). Stockholder Communication and EngagementWe actively engage with our stockholders throughout the year to seek their input on a variety of topics, including our corporate governance practices and our role in the pharmaceutical supply chain (see page 29).Executive CompensationAlignment with Stockholders' InterestsWe align executive compensation with the Company's performance through performance metrics. We also require executives to adhere to stock ownership guidelines and holding requirements that align their interests with those of our stockholders and encourage long-term growth (see page 46). ClawbackWe have the right to claw back the value of cash and equity awards held by current and former executives as a result of misconduct, including misconduct that leads to the restatement of our financial statements. We will publicly disclose instances of clawback pursuant to the Clawback Disclosure Policy adopted in August 2018 (see page 44). Independent Compensation ConsultantThe consultant to our Compensation and Succession Planning Committee provides no other services to the Company (see page 48).Rights of StockholdersAnnual Election of DirectorsAll directors of our Board are elected annually. Majority Vote StandardOur bylaws and corporate governance principles establish majority voting standards for the election of directors and require each director nominee to tender an irrevocable resignation prior to each annual meeting in the event an incumbent director does not receive the required votes for re-election (see page 28). Removal of Directors With or Without CauseOur organizational documents permit stockholders to remove directors with or without cause. Right to Call Special MeetingsStockholders with at least 25% of the outstanding shares of our common stock have the right to call special meetings. Proxy AccessGAAP financial results beyond those discussed in Appendix A, stockholder, or a group of up to 20 stockholders, who have continuously owned at least 3% of our outstanding common stock for three years or more may nominate directors to fill up to the greater of two or 20% of the available board seats (see page 30). Annual Say-on-Pay VoteWe have an annual say-on-pay vote (see page 62). No Supermajority RequirementMajority vote is required for stockholder action. No Poison PillWe do not have a "poison pill" stockholder rights agreement in place. 6![]()

2019 AmerisourceBergen Proxy |Highlights of our Corporate Governance Practices and PoliciesCorporate CitizenshipOverviewOur Company Purpose is that we are united in our responsibility to create healthier futures. We recognize that the economic, social and physical environments in which our company operates are integral to our ability to deliver better patient outcomes. In every aspect of our Company, we seek to integrate corporate citizenship and sustainability into our daily actions as we live our Purpose. Our corporate citizenship framework outlines opportunities in the work we do, the people who do it, and the communities we serve. Environmental SustainabilityWe have implemented practices that reduce energy use and waste, such as our deployment of a data management system to allocate and track usage of resources. We have made investments in waste optimization programs, energy efficiency projects, renewable energy, and sustainable building infrastructure, including the construction of new LEED Certified office spaces. We began responding to the CDP Climate Change Survey in 2016 with information on our largest business unit and expanded to enterprise-wide information in our 2017 response. In 2018, we again submitted an enterprise-wide response and will continue to do so annually. Diversity & InclusionWe continue to foster an inclusive culture that attracts, develops, retains and engages a diverse workforce. We participate in multiple benchmarking reports and applications to track our progress and stay up-to-date on industry best practices. AmerisourceBergen has been recognized since 2017 by Diversity Inc. as a noteworthy company based on our continued commitment to advance our programs, training and practices. Community OutreachWe leverage associate volunteer opportunities and social investments to increase access to healthcare for human and animal populations and ensure prescription drug safety. In addition, the AmerisourceBergen Foundation is a separate not-for-profit charitable giving organization established by the Company to support health-related causes that enrich that global community. During fiscal year 2018, the Foundation donated nearly $5 million to 40+ organizations in support of its mission. For further details, please see the full discussion relatingrefer to our corporate governance policies and practices and our leadership structure in this proxy statement under the section titled "Corporate Governance and Related Matters—Corporate Governance."![]()

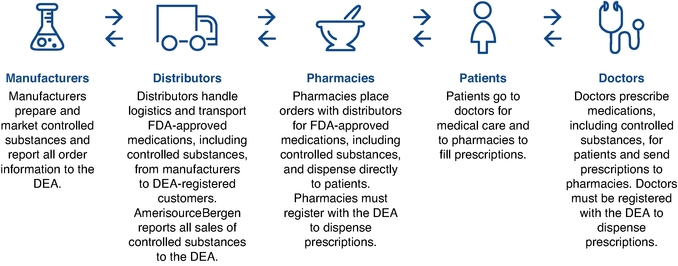

7Oversight of Controlled Substances|2019 AmerisourceBergen ProxyOVERSIGHT OF CONTROLLED SUBSTANCESOur Role in the Supply Chain and Response to the Opioid EpidemicAmerisourceBergen's primary business is the wholesale distribution of pharmaceutical products. We manage the secure transportation of medication, a small part of which includes opioids and other controlled substances, from manufacturers to customers such as licensed hospitals and pharmacies. We do not prescribe medications or take any action to create supply or demand for medications.Our role in the healthcare supply chain has provided us with perspectiveAnnual Report on the opioid epidemic. We understand with utmost clarity that this is a complex, multifaceted and cross-sectoral problem that requires action, attention and a collaborative approach. While prescription opioid medications represent less than two percent of AmerisourceBergen's annual revenue, as a company dedicated to creating healthier futures we feel that it is our duty and responsibility to commit resources and expertise to help fight opioid misuse and abuse in the United States.Our efforts to prevent the diversion and misuse of controlled substances—including and especially prescription opioids—span more than 30 years. Presently, our multifaceted approach includes ensuring safe and secure storage and distribution, maintaining operational integrity, and advocatingForm 10-K for the highest regulatory standards forfiscal year ended September 30, 2021.pharmaceutical supply chain. We are also committed to providing communities across the country with resources to help prevent the abuseCOVID-19 pandemic, AmerisourceBergen has been guided by its purpose of opioids. Data indicates that the efforts of multiple stakeholders are making an impact. For example, according to recent data from the Centers for Disease Control and Prevention, the overall national opioid prescribing rate declined from 2012 to 2017. However, as opioid abuse persists, we remain steadfastly committed to our efforts to help thwart the opioid epidemic.Overview of the Supply Chain1The United States Drug Enforcement Administration (DEA) sets quotas that limit the amount of certain controlled substances that manufacturers may produce. The DEA is also responsible for federal regulatory oversight and enforcement of the closed system of controlled substance distribution. As illustrated below, AmerisourceBergen is one linkbeing united in the supply chain for medications approved by the United States Food and Drug Administration (FDA), including controlled substances.

Maintaining Operational IntegrityAmerisourceBergen takes very seriously its commitmentresponsibility to create healthier futures. OneWe implemented measures to both protect the welfare of our team members and enable our businesses to continue to play their crucial role in supporting the most fundamental ways we achieve this is by creating highly efficient and, more importantly, safe access to medications.1This illustration is meant to depict the limited rolesustainability of a distributor in the pharmaceutical supply chain and is not meantenabling patient access. Since March 2020, our Board has received regular updates from management on the Company’s COVID-19 response and has been aligned in support of initiatives undertaken to depictprotect team members and to augment business operations.many complexitieshealth of our team members, we implemented numerous safety precautions in response to the ongoing COVID-19 pandemic, such as mandatory health and interrelationships betweentemperature monitoring, face coverings and social distancing requirements. We also supplied our team members with personal protective equipment, enhanced facility cleaning and access to sanitizing supplies, and supported remote work options where available. In addition to utilizing a peer-to-peer safety program, we regularly convene our company leaders to review and evaluate safety data and issue operational excellence scorecards. Distribution center team members receive training on proper safety procedures and incentive opportunities, with safety performance tracked and shared across the organization. As the COVID-19 pandemic evolves, we plan to continue to monitor and look for ways to further enhance our safety protocols.![]()

partieswellness resources. Additionally, team members whose household income was impacted, such as by a spouse experiencing job loss, were offered financial support through the AmerisourceBergen Associate Assistance Fund.chain.chain, in addition to focusing on our normal supplier processes, our teams worked throughout the COVID-19 pandemic to ensure that critical medications were allocated to our customers fairly to facilitate optimal patient access. We employ real-time data and analytics to facilitate actionable channel solutions and awareness for commercial and government stakeholders. We continue to support equitable access to COVID-19 vaccines through our Good Neighbor Pharmacy partners, including our partnership with the Federal Retail Pharmacy program, to support vaccination efforts across the U.S. We also delivered COVID-19 vaccines to more than 30 countries around the world. Through the work of the AmerisourceBergen Foundation we are supporting underrepresented communities through non-profit partners to enhance equitable education and access to COVID-19 vaccines.![]()

81 3Contentsour ESG activities. In fiscal year 2021, our notable ESG highlights included:![[MISSING IMAGE: tm2133602d1-fc_ouresgpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-fc_ouresgpn.jpg)

![]()

20192022 AmerisourceBergen Proxy | P|ROXY STATEMENT HIGHLIGHTSWe take no actionAmerisourceBergen has a longstanding commitment to promote prescribing or otherwise increase the demand for opioidsensuring a safe and we do not offer our sales representatives compensation or incentives of any kind that target opioid orders. Additionally, our sales force receives training to fortify its diversion control knowledge and compliance obligations according to both the latest regulatory guidelines and AmerisourceBergen's policies and procedures.Ensuring Safe and Secure DistributionCompliance and Diversion Control. Ensuring the safety and security of theefficient pharmaceutical supply chain is paramountchain. Our wholesale pharmaceutical distribution business plays a key, but specific, role of providing safe access to our business. Sincethousands of important medications to enable healthcare providers to serve patients with a wide array of clinical needs across the 1980s, AmerisourceBergen has invested in technology, personnel and other resources that enable us to continuously evaluate, strengthen, and expand the proven measures we have implemented to maintain the integrity of the orders we ship from the time they arrive in our facilities to the time they are delivered to our customers.This process includes:

Due diligence. We employ a sophisticated diversion control team consisting of internal and external resources, including former law enforcement and DEA professionals, diversion investigators and pharmacists. This team performs due diligence on potential and current customers, including verification of their regulatory licenses, in order to determine their eligibility to purchase controlled substances from us. This team maintains a robust order monitoring program, conducts customer site visits, reviews customer policies and identifies and reports suspicious orders to the DEA and, where appropriate, to state regulators.

Order monitoring. We maintain a sophisticated diversion control program emanating from the 1980s, when our predecessor companies developed programs to identify and report suspicious orders. The program has gone through ongoing changes and enhancements since that time. Today, the program includes mathematical algorithms and data analytics, peer group comparisons, statistical analyses, and dashboards with comprehensive ordering and customer information.

Daily reporting. Our diversion control program provides daily reports to the DEA of all controlled substance shipments (which includes all opioid medications), including the quantity, type, and recipient of each shipped order. In addition, we cancel and report all orders we determine to be suspicious.

Customer Licensing and Monitoring. We confirm that all customers are appropriately licensed by regulatory agencies, and we continuously monitor our customers during our relationship with them. We discontinue customer relationships where we have identified an increased potential for diversion by the customer, and we support law enforcement efforts to investigate pharmacies.continuously enhanced ourtaken substantial steps to help prevent the diversion control program throughout our history, including fulsome updates in 1998, 2007of controlled substances and 2014-2015are committed to build on current data, respondjoining other healthcare stakeholders, government entities, civic organizations, law enforcement agencies and individuals to prescription drug abuse trends and incorporate advanced technological capabilities. We continue to evaluate and evolve our program to ensure that we are using our data and resources inhelp address the most appropriate and effective way. Our technology provides a high level of insight into our customers' ordering patterns and order outliers and an elevated degree of actionable intelligence that assists with our ongoing diversion control efforts.Additionally, AmerisourceBergen has established a diversion control advisory committee comprised of a cross-functional team of senior executives who meet regularly with the Vice President of Diversion Control to discuss and review our diversion control program. This committee reevaluates our diversion control program at least annually. We also have established a cross-functional Opioid Task Force dedicated to bringing together business, operations, regulatory, compliance, and legal team leads to put our best thinking to use as we continually evaluate and develop our efforts in this area. Governance and Oversight of Risks Associated with Opioid Distribution.Company'sCompany’s distribution of opioid medications. Our Compliance and Risk Committee provides further oversight on these matters and expertise at the Board level. The Board (and/or the Compliance and Risk Committee) receive at least quarterly updates on our anti-diversion program, the status of pending litigation related to the distribution of opioids, legislative and regulatory developments related to controlled substances, and shareholder feedback. For additional information on the Board’s oversight of risks, see “Corporate Governance and Related Matters — Corporate Governance — Risk Oversight and Management” beginning on page 25 of this see "Corporate Governanceproxy statement. Global Settlement Status The Company has continued to move forward with discussions regarding a comprehensive proposed settlement agreement that, if all conditions are satisfied, would resolve a substantial majority of opioid lawsuits filed by state and local governmental entities. As of mid-January 2022, 45 states and a significant number of subdivisions have expressed their consent to the proposed settlement. AmerisourceBergen, as well as other participating distributors, are scheduled to decide by late February 2022 whether to move forward with executing the settlement agreement along with the consenting States and subdivisions. If the companies decide to move forward, the settlement agreement is expected to become effective in early April 2022. Under the proposed settlement, the Company would pay up to approximately $6.4 billion over 18 years. The proposed settlement would also establish a clearinghouse that consolidates data from all three distributors, which will be available to the settling states to use as part of their anti-diversion efforts. ![[MISSING IMAGE: tm2133602d1-fc_globalpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-fc_globalpn.jpg)

![]()

![]()

95|2019 AmerisourceBergen Proxyand Related Matters—Corporate Governance—Risk Oversight and Management" beginning on page 26 describes in detail our role in the pharmaceutical supply chain, our Board’s oversight of this proxy statement. Our Board of Directors actively oversees and reviews the effectiveness of our compliance programs, including our diversion control program. The Board and its Audit Committee receive regular updates from the Company's management on our compliance program's guidelines, training initiatives, monitoring activities and any enforcement or corrective responses. The Audit Committee is regularly apprised of legal matters relating to the Company while the Governance and Nominating Committee oversees the Company's support of charitable, educational and community outreach organizations that are dedicated to addressing various aspects of the opioid epidemic. The Board also supports management'smanagement’s efforts more broadly to develop meaningful solutions to the opioid epidemic, which requires close collaboration with pharmacies, manufacturers, doctors, policy makers and other stakeholders in the healthcare industry. The Board is committedour management team’s thoughtful approach to mitigating the risks associated with the Company's distribution of prescription opioid medication while also ensuring that the Company continues to facilitate safe access to prescription opioid medications to assist in painenterprise risk management, based on the recommendations of medical professionals and as approved by the FDA and DEA.Advocating for the Highest Regulatory StandardsAmerisourceBergen enthusiastically endorses government efforts to regulate opioids from the time they are produced to the time they are dispensed to patients. Ourour commitment to help combat the opioid epidemic is demonstrated by our coordination across our industry with other distributorsoperational integrity and the Healthcare Distribution Alliance and close collaboration with legislators, policy makers and regulatory agencies to continue to monitor, stop and report suspicious orders and minimize and deter diversion. This commitment to addressing the opioid epidemic is further demonstrated by, among other things, our participation in the Anti-Diversion Industry Working Group and the Collaborative for Effective Prescription Opioid Policies, two stakeholder groups aimed at developing clearer and safer drug distribution regulations and policies and increasing visibility to industry-wide data.In addition, the Company's government affairs team regularly engages with state and federal legislators and regulators to discuss potential policy solutions to help address opioid abuse and diversion. We are continuously working to identify and explore innovative ideas to combat the epidemic and we work diligently every day to help educate policymakers on the complexities of the supply chain and how distributors play a vital and limited role in the closed system of controlled substance distribution.Community OutreachThe AmerisourceBergen Foundation is a separate not-for-profit charitable-giving organization, formed in 2014, to support health-related causes that enrich the global community. The AmerisourceBergen Foundation teams up with numerous innovative and non-profit partners who share AmerisourceBergen Corporation's and the AmerisourceBergen Foundation's dedication to addressing the opioid epidemic. The Foundation is committed to providing communities across the country with the resources they need to help combat the epidemic of opioid abuse and misuse. Examples of these initiatives include the following:Drug Deactivation Resource Initiative. In December 2017, the AmerisourceBergen Foundation launched the Drug Deactivation Resource Initiative. Through this initiative, the Foundation provides communities and organizations across the country with access to drug deactivation resources that enable community members to dispose of unused or expired prescription drugs in a safe and effective manner. As of November 2018, nearly 1 million drug deactivation resources have been donated to 44 states and 140 organizations across the U.S.Opioid Resource Grant Program. Along with the Drug Deactivation Resource Initiative, the AmerisourceBergen Foundation is committed to contributing resources and funding to help address opioid abuse and misuse. To that end, in April 2018, the Foundation formed a new grant program called the Opioid Resource Grant Program. Throughout 2018, the Opioid Resource Grant Program partnered with a variety of community-based organizations devoted to creating action-oriented solutions to address the opioid epidemic. The Opioid Resource Grant Program receives guidance and leadership from an External Advisory Committee (EAC) comprised of key independent stakeholders, including influential thought leaders with expertise in public health, community-based grant-making and community coalition building. Additionally, as application volume has increased, the Opioid Resource Grant Program has established a second EAC to assist with the grant-making decision process. To10![]()

2019 AmerisourceBergen Proxy |Oversight of Controlled Substancesdate, the Foundation has received more than 300 letters of intent from not-for-profit organizations seeking support for opioid-related initiatives and provided more than $3.4 million in grants and in-kind donations.Opioid Awareness Education. In February 2018, the AmerisourceBergen Foundation, together with Prevention Action Alliance and Everfi, announced a new digital education initiative aimed at combating opioid misuse and empowering Ohio high school students with the knowledge and resources to make informed decisions about prescription medications. In August 2018, the Foundation announced plans to launch a similar program in Florida in partnership with Everfi and the Florida Coalition Alliance. Plans are underway to expand education initiatives into additional geographies.Board Report on Oversight of Opioid RisksIn November 2018, the Company's Board of Directors recommended the preparation of a report by relevant members of the Company's management on the Company's response to the opioid epidemic. The Governance and Nominating Committee, which is composed entirely of independent directors, will be responsible for overseeing management's development and publication of this report. The Board has committed to make the report publicly available by September 30, 2019. The report will build on the Company's commitment to transparency by providing robust disclosure of its response to the opioid epidemic, including the Board's oversight of risks associated with the Company's role as a distributor of prescription opioid medications. This report will address, among other things, the Company's role in the supply chain, the oversight responsibilities of the Board and its committees for monitoring business risks related to the distribution of opioid medications, the Company's compliance organization and programs, including its diversion control, and order monitoring programs, as well asour community and team member outreach efforts. A copy of this report can be found on our website at investor.amerisourcebergen.com.![]()

discussionrange of topics, including strategic priorities and performance, risk management practices, corporate governance and executive compensation practices, and ESG initiatives. Members of our Board and management team participate in these engagements and incorporate feedback from shareholders into their decision-making processes.![[MISSING IMAGE: tm2133602d1-fc_sharepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-fc_sharepn.jpg)

![[MISSING IMAGE: tm2133602d1-fc_expandpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-fc_expandpn.jpg)

Company's social and charitable efforts to help proactively combatoverall structure of our executive compensation program. However, they believed the magnitude of the opioid epidemic.litigation settlement accrual should be considered in the Compensation Committee’s fiscal year 2021 executive payout decisions, along with more detailed disclosure on our decision-making process.![]() 17

17 Shareholder Feedback and Responsiveness What We Heard From Shareholders Action We Took in Response Compensation-Related Themes Reflect in the Compensation Committee’s decisions for fiscal year 2021 the magnitude of the opioid settlement accrual recorded in fiscal year 2020 ☑ ☑ Provide clarity on how the Compensation Committee considers discretion for significant, non-recurring financial events ☑ Commitment to disclose the Compensation Committee’s decision process for any potential use of discretion for adjustments related to significant, non-recurring financial events on a go-forward basis, as appropriate ☑ Enhanced transparency of Compensation Committee decision-making process for executive compensation more broadly ☑ Compensation Committee to review any potential adjustments to reported financial results on a quarterly basis, and determine final approval of adjustments at year end Increase alignment of long-term incentives to shareholder value creation ☑ Added a relative TSR modifier to the performance share awards under the long-term incentive plan, which requires above median performance at the 55th percentile for target payout (see page 49) ☑ Beginning with fiscal year 2022 grants, implemented a post-vesting holding requirement on 50% of earned performance shares of two years for our CEO and one year for other NEOs Enhance clawback provision and disclosure ☑ Created a single compensation recoupment policy that applies to all incentive compensation and formally expands the list of actions that could result in a clawback Support the incorporation of measurable, ESG-related metric(s) into compensation program ☑ Committed to review and evaluate the best approach to inclusion of an ESG-related measure or measures in the compensation program by fiscal year 2023 Board and ESG-Related Themes Provide additional transparency on human capital disclosure ☑ Enhanced human capital disclosure in 10-K and disclosed EEO-1 report (available at investor.amerisourcebergen.com/governance/policies) Enhance focus on future Board refreshment ☑ Board evaluation process for fiscal year 2022 will consider, among other topics, Board composition and refreshment (see page 27) ![]()

![]()

Age Director

Since Committee Membership Name Executive AC CSPC CRC FC GSCRC MIC ![]()

68 2015 X X ![]()

60 2011 Chair ![]()

60 2015 X X Chair X ![]()

72 2008 X X ![]()

71 2013 X Chair X X ![]()

74 2002 X EO EO EO EO EO EO ![]()

63 2010 X Chair X ![]()

63 2006 X X Chair ![]()

68 2004 X X Chair ![]()

69 2020 X Chair X Number of Meetings in FY2021: — 9 4 4 7 5 4 Board Snapshot ![]() 19

19![[MISSING IMAGE: tm2133602d1-bc_proxypn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-bc_proxypn.jpg)

![[MISSING IMAGE: tm2133602d1-bc_overallpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/tm2133602d1-bc_overallpn.jpg)

Ornella

Barra Steven H.

Collis D. Mark

Durcan Richard W.

Gochnauer Lon R.

Greenberg Jane E.

Henney, M.D. Kathleen W.

Hyle Michael J.

Long Henry W.

McGee Dennis M.

Nally Gender Male ![]()

![]()

![]()

![]()

![]()

![]()

![]()

Female ![]()

![]()

![]()

Race/ Ethnicity African American / Black ![]()

American Indian/ Alaska Native Asian Caucasian/White ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Hispanic/ Latino Pacific Islander ![]()

Board and Governance Practices — Enabling Effective Oversight of Management ![]()

Majority of director nominees are independent (eight out of ten) ![]()

All members of the Audit, Compensation and Succession Planning, Governance, Sustainability and Corporate Responsibility, and Merger Integration Committees are independent ![]()

Lead Independent Director with clearly-defined responsibilities (see pages 22-23) ![]()

Thoughtful succession planning process in place; committed to splitting the roles of Chairman of the Board and Chief Executive Officer, commencing with the next Chief Executive Officer. At that time, the Chairman role will be assumed by an independent director ![]()

Full Board plays an active role in risk oversight and regularly receives reports on risk exposure from management ![]()

Board oversight of ESG reporting and disclosure practices ![]()

Board oversight of enterprise risk management and legal and regulatory compliance ![]()

Strong commitment to transparency: published a report on the safe and secure distribution of controlled substances ![]()

Strict overboarding policy for our CEO and non-employee directors (see page 13) ![]()

Tenure policy and regular refreshment of the Board and its committee Chairs (see page 27) ![]()

Comprehensive annual evaluation process for the Board and each of its committees (see page 27) ![]()

Robust shareholder communication and engagement Shareholder Rights — Ensuring Accountability to our Shareholders ![]()

Majority vote standard ![]()

Removal of directors with or without cause ![]()

Right to call special meetings at 25% ![]()

Proxy access ![]()

No supermajority requirement ![]()

Declassified Board ![]() 1 11

1 11Corporate Governance and Related MattersP|ROXY 2019STATEMENT HIGHLIGHTS | 2022 AmerisourceBergen Proxy Executive Compensation Practices — Linking Pay with Performance and Mitigating Risk What We Do ![]()

Use financial metrics to make a substantial portion of executive pay contingent on performance ![]()

Engage with shareholders on compensation and governance ![]()

Cap payouts under our annual cash bonus plan and performance share plans ![]()

Apply robust clawback obligations to annual cash bonus and equity awards for executive officers ![]()

Require our CEO to own stock equal in value to six times his base salary, and our CFO and other executive officers to own stock equal in value to three times their respective base salaries ![]()

Require executive officers to retain all equity awards until required ownership levels are met ![]()

Require two-year post vesting holding requirement for our CEO and one-year holding period for NEOs on 50% of PSU awards (beginning in fiscal year 2022) ![]()

Consider a peer group in establishing named executive officer compensation and published compensation survey data for all other executive officers ![]()

Require forfeiture of awards upon violation of restrictive covenants ![]()

Require a double-trigger for change in control payments ![]()

Consider burn rate in equity grant decisions and manage use of equity awards conservatively What We Do

Not Do ![]()

Tie incentive compensation to specific product sales, including prescription opioid medication sales ![]()

No short-sales, hedging or pledging of our stock permitted by our executive officers and directors ![]()

Backdate or retroactively grant restricted stock units ![]()

Pay dividends on unearned and unvested performance shares ![]()

Provide tax gross-ups in the event of a change in control ![]()

CORPORATE GOVERNANCE AND RELATED MATTERSCorporate Governance and Related MattersITEMELECTION OF DIRECTORSHow often are directors elected?20192022 Annual Meeting of StockholdersShareholders will be elected to serve a term of one year.year and is expected to hold office until the 2023 Annual Meeting of Shareholders and until their successors are elected and qualified. Similarly, any director who is appointed to fill a vacancy on the Board will serve until the next annual meeting of stockholdersshareholders after his or her appointment and until his or her successor is elected and qualified.What will the size of the Board of Directors be following the 2019 Annual Meeting of Stockholders?The size of the Board of Directors will be nine.Who are this year's nominees?Ornella Barra, Steven H. Collis, D. Mark Durcan, Richard W. Gochnauer, Lon R. Greenberg, Jane E. Henney, M.D., Kathleen W. Hyle, Michael J. Long and Henry W. McGee.Which of this year's nominees are independent?Messrs. Durcan, Gochnauer, Greenberg, Long and McGee and Dr. Henney and Ms. Hyle are independent (as independence is defined in Section 303A of the NYSE Listed Company Manual and in our corporate governance principles).Are there any family relationships among AmerisourceBergen's directors and executive officers?No.What is the term of office for which this year's nominees are to be elected?The nominees are to be elected for a term of one year and are expected to hold office until the 2020 Annual Meeting of Stockholders and until their successors are elected and qualified.What if a nominee is unwilling or unable to serve?Why does Alliance designate a nominee?common stock ("Common Stock").Stock. On May 1, 2014, Walgreens Boots Alliance notified us that they had acquired at least five percent of our Common Stock. Ms. Barra, Co-ChiefChief Operating Officer, International of Walgreens Boots Alliance, has been designated by Walgreens Boots Alliance to serve on our Board. She was appointed to the Board on January 16, 2015 and is a current nominee for election as director. In addition, upon the acquisition in full by Walgreens Boots Alliance and its subsidiaries of 19,859,795 shares of AmerisourceBergenour Common Stock in the open market, Walgreens Boots Alliance will be entitled to designate a second director to the Board of Directors. For so long as Walgreens Boots Alliance has a right to designate a director to the Board, subject to certain exceptions, including matters related to acquisition proposals, Walgreens Boots Alliance and its subsidiaries will be obligated to vote their shares in accordance with our Board on all matters submitted to a vote of our stockholders.shareholders. Please refer to "Related“Related Person Transactions"Transactions” beginning on page 6383 of this proxy statement and our Current ReportReports on Form 8-K filed on March 20, 2013, January 8, 2021 and June 2, 2021 for more detailed information regarding the Amended and Restated Shareholders Agreement and related agreements and arrangements.12![]()

Contents2019 AmerisourceBergen Proxy |Corporate GovernanceDirector Nominees and Related MattersHow does our Governance and Nominating Committee identify and evaluate director nominees?NominatingCorporate Responsibility Committee seeks director nominees who possess qualifications, experience, attributes and skills that will enable them to contribute meaningfully to the leadership of our Board and to effectively guide and supervise management in driving AmerisourceBergen'sAmerisourceBergen’s growth and financial and operational performance. Each director nominee should:■■stockholders;shareholders; and■![]() 113

113NominatingCorporate Responsibility Committee has identified the following expertise, experience, attributes and skills that are particularly relevant to AmerisourceBergen: ■Corporate Governance■Distribution and Logistics■Executive Leadership■Financial Literacy■Global Markets■Healthcare■Information Technology■Regulatory■Risk Oversight■Sustainability and Corporate Citizenship■Talent Management and Executive CompensationBoard, including women and minorities, but do not have a specific diversity policy for selection of our directors.Board. We believe that diversity is essential to encourage fresh perspectives, enrich the Board'sBoard’s deliberations and avoid the dominance of a particular individual or group over the Board'sBoard’s decisions. In accordance with our corporate governance principles and the Governance, Sustainability and Corporate Responsibility Committee charter, the Governance, Sustainability and Corporate Responsibility Committee has formalized its diversity focus to include, and have any search firm that it engages include, women and ethnically and racially diverse candidates in the pool from which the committee selects new director candidates. The Governance, Sustainability and NominatingCorporate Responsibility Committee evaluates all potential director nominees using the same criteria, regardless of the source of the nominee. Accordingly, all potential director nominees, including shareholder nominees, are assessed using the criteria outlined above. The Governance, Sustainability and Corporate Responsibility Committee may consider and evaluate director nominees identified by our stockholdersshareholders as described below in the Sectionsection titled "Stockholder“Shareholder Engagement—StockholderShareholder Recommendations for Director Nominees."nominee'snominee’s biography and an assessment of the above-mentioned expertise, experience, attributes and skills that the nominee possesses.![]()

![]()

13Corporate Governance and Related Matters|20192022 AmerisourceBergen Proxy | ![[MISSING IMAGE: ph_ornellabarra-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_ornellabarra-bwlr.jpg)

ORNELLA BARRA

6568

Director since January 2015Member of our Committee Principal Occupation, Business and DirectorshipsaChief Operating Officer, International of Walgreens Boots Alliance, Inc. Previously, she served as Co-Chief Operating Officer of Walgreens Boots Alliance, Inc. Previously, shefrom June 2016 until April 2021. Ms. Barra served as Executive Vice President of Walgreens Boots Alliance, Inc. and President and Chief Executive of Global Wholesale and International Retail from February 2015 until June 2016. Ms. Barra served as Chief Executive, Wholesale and Brands of Alliance Boots GmbH from September 2013 until January 2015 and as Chief Executive of the Pharmaceutical Wholesale Division of Alliance Boots GmbH from January 2009 until September 2013. Prior to thather role as Chief Executive of the Pharmaceutical Wholesale Division, Ms. Barra was the Wholesale and Commercial Affairs Director and a Board member of Alliance Boots plc. Prior to the merger of Alliance UniChem Plc and Boots Group plc, Ms. Barra was Executive Director of Alliance UniChem Plc, having been appointed to its Board in 1997. Ms. Barra has been a member ofserved on the Board of Directors of Assicurazioni Generali, one of the largest Italian insurance companies, since April 2013,Alliance Participations Limited. Ms. Barra is an honorary Professor of the University of Nottingham'sNottingham’s School of Pharmacy and is a member of the International Advisory Council of Bocconi University. Ms. Barra was formerly a member of the board of Directors of Assicurazioni Generali S.p.A., one of the largest Italian insurance companies, from April 2013 to April 2019. Ms. Barra was a member of the Board of Directors of Alliance Boots GmbH between June 2007 and February 2015.2015, and was Chairman of its Corporate Social Responsibility Committee from 2009 to 2014. She is a memberserves as Chair of the Board of International Federation of Pharmaceutical Wholesalers, Inc.of the Board of Efficient Consumer Response Europe.Key Attributes, Expertise, Experience and Skills:▪■Other Public Company Boards:MarketsMarkets:: Demonstrated Demonstrates expertise and understanding of global markets by leading and expanding international wholesale and retail operations of multinational company.■ExpertiseExpertise:: Heads global wholesale and international retail operations for Walgreens Boots Alliance, Inc. ExtensiveAcquired extensive experience in pharmaceutical wholesale distribution and pharmaceutical retail industries through long career at Alliance Boots GmbH and predecessor companies, and trained as a pharmacist.■OversightOversight:: Serves as Co-ChiefChief Operating Officer, International of Walgreens Boots Alliance, Inc. and served as a director of one of the largest insurance companies in Italy.■CitizenshipResponsibility:: Serves as Chair of the Walgreens Boots Alliance, Inc. Corporate Social Responsibility Committee and previously served as Chairman of the Corporate Social Responsibility Committee for Alliance Boots GmbH.■OversightOversight:: Serves Served as Chair of Appointments and Remuneration Committee at Assicurazioni Generali. STEVENSteven H. COLLIS

![[MISSING IMAGE: ph_stevenhcollis-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_stevenhcollis-bwlr.jpg)

5760

Chairman of the Board since

March 2016

Director since May 2011Chair of our Committee

(Chair) Principal Occupation, Business and DirectorshipsBoard'sBoard’s Chairman since March 2016. From November 2010 to July 2011, Mr. Collis served as President and Chief Operating Officer of AmerisourceBergen Corporation. He served as Executive Vice President and President of AmerisourceBergen Drug Corporation from September 2009 to November 2010, as Executive Vice President and President of AmerisourceBergen Specialty Group from September 2007 to September 2009 and as Senior Vice President of AmerisourceBergen Corporation and President of AmerisourceBergen Specialty Group from August 2001 to September 2007. Mr. Collis has held a variety of other positions with AmerisourceBergen Corporation and its predecessors since 1994. Mr. Collis is a member of the American Red Cross Board of Governors, and the Board of International Federation of Pharmaceutical Wholesalers, Inc. and CEOs Against Cancer (PA Chapter), and isHe served as a member of the American Red Cross Board of Governors. He previously served as a Member of the Boardboard of Thoratec Corporation from 2008 to 2015.Key Attributes, Expertise, Experience2015 and Skills:as a member of the board of CEOs Against Cancer (PA Chapter) from 2014 to 2019.■Other Public Company Boards:ExpertiseExpertise:: Has held various senior executive leadership positions with AmerisourceBergen Corporation and has extensive business and operating experience in wholesale pharmaceutical distribution and in-depth knowledge of the healthcare distribution and services market.■MarketsMarkets:: Leads a multinational company that has significantly expanded international operations.■OversightOversight:: Serves as Chairman, President and Chief Executive Officer and director of AmerisourceBergen and previously served as director of Thoratec Corporation. ![]()

141 15![]()

overnance and 2019Related Matters | 2022 AmerisourceBergen Proxy|Corporate Governance and Related Matters MARK DURCAN

![[MISSING IMAGE: ph_dmarkdurcan-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_dmarkdurcan-bwlr.jpg)

57

60

Director since September 2015Member of our Committee our FinanceCommittee

ExperiencePrincipal Occupation, Business Experience and Directorshipsin a variety of roles at Micron Technology, Inc., including as President and Chief Operating Officer of Micron Technology, Inc. from June 2007 to February 2012, as Chief Operating Officer from February 2006 to June 2007, and as Chief Technology Officer from June 1997 to February 2006. Between 1984 and February 2006, Mr. Durcan held various other positions with Micron Technology, Inc. and its subsidiaries and served as an officer from 1996 through his retirement. Mr. Durcan served as a director of MWI Veterinary Supply, Inc. from March 2014 until its acquisition by AmerisourceBergen in February 2015. Mr. Durcan has served as a director for Advanced Micro Devices since October 2017, for Veoneer since April 2018, and for ASML Holding NV since April 2020. He served as a director at Freescale Semiconductor, Inc. from 2014 through 2015 and2015. Mr. Durcan has served asbeen a Director ofdirector for St. Luke'sLuke’s Health System of Idaho since February 2017. Mr. Durcan2017 and has served on the board of Trustees of Rice University since June 2020. He has also served on the Semiconductor Industry Association Board and the Technology CEO Council.Key Attributes, Expertise, ExperienceSkills:Expertise■Other Public Company Boards:areaareas of finance, executive leadership and strategic planning in his former roles as Chief Executive Officer and Chief Operating Officer of Micron Technology, Inc.■insightsinsight into wholesale distribution of animal health products.■ RICHARDRichard W. GOCHNAUER

![[MISSING IMAGE: ph_richardwgochnauer-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_richardwgochnauer-bwlr.jpg)

6972

Director since September 2008Chair of our Finance Committeeand a member of ourPlanning CommitteeExecutive Committee

Risk Principal Occupation, Business and DirectorshipsUGI Corporation, Golden State Foods Corporation, Vodori Inc., and Rush University Medical Center and previously served as a director of UGI Corporation from 2011 until 2020, Fieldstone Communities, Inc. from 2000 to 2008 and United Stationers Inc. from July 2002 to May 2011. Mr. Gochnauer is also a member of the Boards of Opportunity International and the Center for Higher Ambition Leadership.Key Attributes, Expertise, ExperienceLeadership and Skills:Lead Director for SC Master Fund.■Other Public Company Boards:■UGI Corporation, Golden State Foods Corporation and Vodori Inc. and held senior executive leadership roles at United Stationers Inc. and Golden State Foods Corporation.■ ![]()

![]()

15Corporate Governance and Related Matters|20192022 AmerisourceBergen Proxy | C LONLon R. GREENBERG

![[MISSING IMAGE: ph_lonrgreenberg-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_lonrgreenberg-bwlr.jpg)

6871

Director since May 2013Chair of our Audit Committeemember of our Risk (Chair)CommitteeFinance CommitteeCorporate Responsibility Principal Occupation, Business and DirectorshipsCorporation'sCorporation’s Board of Directors from 1996 until January 2016 and as director of UGI Utilities, Inc. and AmeriGas Propane, both UGI Corporation subsidiaries. Mr. Greenberg served as Chief Executive Officer of UGI Corporation from 1995 until his retirement in April 2013. Mr. Greenberg served in various leadership positions throughout his tenure with UGI Corporation. He is a member of the Board of Directors of Ameriprise Financial, Inc. and the Board of Directors of the United Way of Greater Philadelphia and Southern New Jersey. Mr. Greenberg is a member of the Board of Trustees of Temple University and the Board of The Philadelphia Foundation andFoundation. He previously served as Chairman of the Board of Directors of Temple University Health System, and as a member of the Board of Directors of Fox Chase Cancer Center. Mr. Greenberg previously servedCenter, as a member of the Board of Directors of the United Way of Greater Philadelphia and Southern New Jersey, and as a member of the Board of Aqua America, Inc.Key Attributes, Expertise, ExperienceSkills:Expertise■Other Public Company Boards:ExpertiseInc.:Financial Expertise: Brings financial literacy and sophistication acquired through various executive, legal and corporate roles, as well as membership on the boards of other NYSE listed companies.■■■ JANEJane E. HENNEY,Henney, M.D.

![[MISSING IMAGE: ph_janeehenney-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_janeehenney-bwlr.jpg)

7174

Lead Independent Director

since March 2016

Director since January 2002Member of our Committee and serves

officio on each of theBoard's Board’s other committees

(other than Special Litigation) Principal Occupation, Business and DirectorshipsBoard'sBoard’s Lead Independent Director since March 2016 and as a Directordirector since January 2002. She has served as Home Secretary for the National Academy of Medicine sincefrom April 1, 2014.2014 to June 2020. Dr. Henney was a Professor of Medicine at the College of Medicine at the University of Cincinnati from January 2008 until December 2012. She served as Senior Vice President and Provost for Health Affairs at the University of Cincinnati from July 2003 to January 2008 and was the Commissioner of Food and Drugs at the United States Food and Drug Administration from 1998 to 2001. Dr. Henney served as Vice President for Health Sciences at the University of New Mexico from 1994 to 1998. She currently serves as a director for The China Medical Board. Dr. Henney previously served as a director on the boards of CIGNA Corporation from April 2004 until April 2018, AstraZeneca PLC from September 2001 to April 2011, and Cubist Pharmaceuticals, Inc. from March 2012 to January 2014. Dr. Henney is a National Association of Corporate Directors (NACD)2014 and The China Medical Board Leadership Fellow.from July 2004 until June 2019. Dr. Henney is a former member of the Board of The Commonwealth Fund and The Monnell Center for the Chemical Senses.Key Attributes, Expertise, ExperienceSkills:Expertise■Other Public Company Boards:■■Regulatory:Regulatory: As a former Commissioner of Food and Drugs for the United States Food and Drug Administration, Dr. Henney has extensive insight into federal regulatory matters. ![]()

161 17![]()

GTable of Contentsovernance and R2019elated Matters | 2022 AmerisourceBergen Proxy|Corporate Governance and Related Matters KATHLEENKathleen W. HYLE

![[MISSING IMAGE: ph_kathleenwhyle-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_kathleenwhyle-bwlr.jpg)

6063

Director since May 2010Member of our

and Succession Planning (Chair)Committee our FinanceCommittee

ExperiencePrincipal Occupation, Business Experience and Directorshipsof the Board of Trustees of Center Stage in Baltimore, MD. Ms. Hyle is a Partner in WKW LLC, a limited liability company, is a former director of The ADT Corporation, andcompany. Ms. Hyle is a former member of the Board of Sponsors for the Loyola University Maryland Sellinger School of Business and Management.Key Attributes, Expertise, ExperienceManagement and Skills:a former member of the Board of Trustees of CenterStage, a non-profit theatre in Baltimore, MD.■Other Public Company Boards:■■ MICHAELMichael J. LONG

![[MISSING IMAGE: ph_michaeljlong-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_michaeljlong-bwlr.jpg)

6063

Director since May 2006Chair of our Compensation andSuccession PlanningCommitteemember ofCorporate Responsibilityour Governance andNominating Committeeand Executive Committee Principal Occupation, Business and Directorshipsiscurrently serves as a member of the Board of TrusteesDirectors of UCHealth and National Western Stock Show since 2018. He served as a member of the Board of Directors of the Denver Zoo.Key Attributes, Expertise, ExperienceZoo from 2010 until 2017.Skills:Expertise■Other Public Company Boards:■■■ ![]()

![]()

17Corporate Governance and Related Matters|20192022 AmerisourceBergen Proxy | C HENRYHenry W. MCGEE

![[MISSING IMAGE: ph_henrywmcgee-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_henrywmcgee-bwlr.jpg)

6568

Director since November 2004Chair of our andNominating Committee andmember of our Audit Committee

Sustainability and Executive Committee

Corporate Responsibility (Chair) Principal Occupation, Business and DirectorshipsFoundation andFoundation. He is currently a member of the Board of Tegna Inc., the Pew Research Center and the Black Filmmaker Foundation. Mr. McGeeHe was recognized by Savoy Magazine in 2016 and 2017 as a member of the Power 300 list of the Most Influential Black Corporate Directors.Key Attributes, Expertise, Experience In 2018, the National Association of Corporate Directors named Mr. McGee to the Directorship 100, the organization’s annual recognition of the country’s most influential boardroom members.Skills:Expertise■Other Public Company Boards:■■ How does ![[MISSING IMAGE: ph_dennismnally-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-008305/ph_dennismnally-bwlr.jpg)

Director since January 2020 recommend that I vote?nineten nominees named in this proxy statement to the Board of Directors.![]()

181 19![]()